Purchasing construction equipment, especially high-ticket items, can be an unsettling process. There are few resources like we have in cars and homes to know what is considered a good price before we buy.

Having the assurance that an equipment purchase will generate net positive cash flows within a year or two makes a five or six-figure price an easier pill to swallow.

In the below example, I break down how to calculate the return on investment (ROI) of a 2013 150-foot boom lift listed at $103,000 on Gearflow.

This methodology is not an exact science but it gives you a good estimate of the ROI of a machine prior to purchasing. You can also factor in additional costs for parts and servicing expenses if you’d like an even more conservative estimate. This kind of analysis is highly recommended in order to help with your negotiation as well as ease your hesitation when adding a new or used piece of equipment to your rental fleet.

1. Determine the Depreciation Cycle

The first step is to determine your depreciation cycle. As soon as you acquire or decide on purchasing a piece of construction equipment, whether used or new, it begins to depreciate. Depreciation is the reduction in the value of the asset with the passage of time.

In this example, we know that the average useful rental life of a 150-foot boom lift, if properly maintained, is around 12 years.

Given that this is a 2013 model, we know that we have about 5 years left of rental value left therefore making the depreciation cycle 5 years or 60 months.

This means that we will get a depreciation value of $1,716 per month by dividing the sale price ($103,000) by the remaining useful life (60 months).

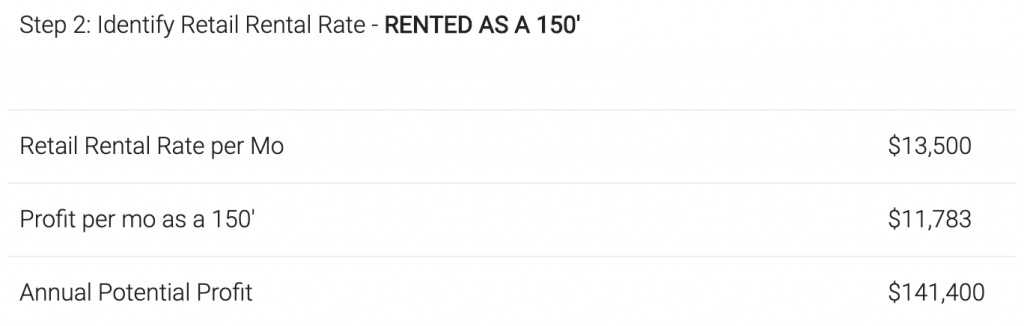

2. Identify the Retail Rental Rate

Based on experience, we know that we can rent this machine for about $13,500 per month. For a more data-informed approach to setting rental rates, data companies such as EquipmentWatch can be extremely useful resources.

This leaves us with a profit of $11,783.33 (rental rate – monthly depreciation) if we receive 100% utilization.

However, we all know 100% utilization is impossible which we adjust for in step 4.

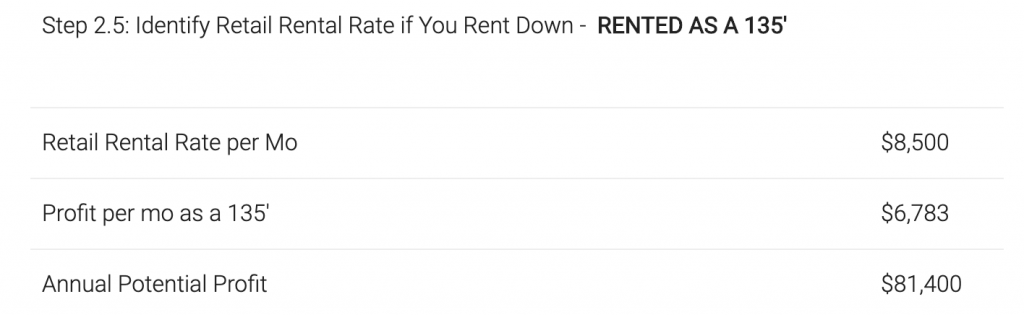

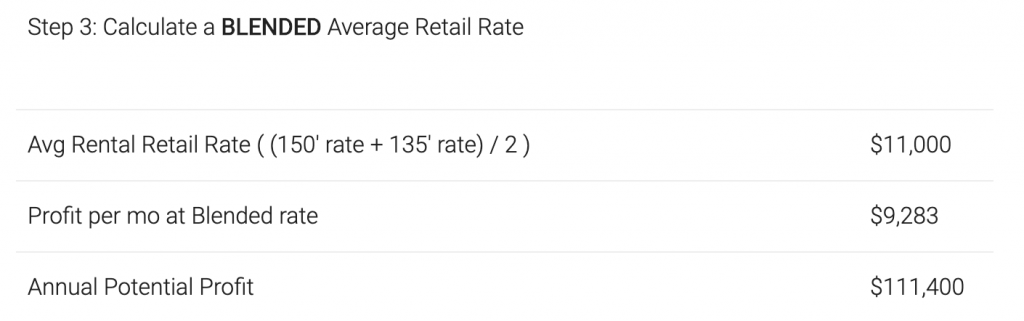

3. Calculate Blended Retail Rate

Something that is often overlooked is that the 150ft boom lift in our example can also be rented as a 135ft boom lift. This is true for most equipment and is important to keep in mind while calculating the ROI of equipment. In order to achieve high utilization rates, you won’t always be renting the equipment for it’s maximum working height or capacity.

In this case, we know we can rent 135ft boom lifts for about $8,500 per month at retail. This would give us a profit of $6,783.33 per month by again subtracting the monthly depreciation from the monthly retail value.

Once all rates are calculated, we need to blend the rates to get an average monthly retail value and average monthly profit. We get this by adding together the individual retail rates and dividing by the number of variables present. In our example, we added the retail rate of our 150ft boom lift ($13,500) to our 135ft boom lift rental rate ($8,500) and divided by 2. This means our blended retail rate is $11,000 per month, giving us a monthly profit of $9,283.33.

4. Estimate Utilization Rate

Knowing that 100% utilization is impossible, we create different utilization tiers to understand profitability per tier.

In our example, we use a 60% utilization rate which equates to $66,840 in annual profit. Multiply that profit over the 5 years of useful rental life and you have $334,000 total profit over 5 years.

| Utilization Rate Comparison Table | Rented as 150′ | Rented as 135′ | At Blended Retail Rate |

| Annual Potential Profit (100% Utilization) | $141,400 | $81,400 | $111,400 |

| At 80% Utilization | $113,120 | $65,120 | $89,120 |

| At 70% Utilization | $98,980 | $56,980 | $77,980 |

| At 60% Utilization | $84,840 | $48,840 | $66,840 |

| At 50% Utilization | $70,700 | $40,700 | $55,700 |

5. Factor in Resale Value

Lastly, you need to factor in what the resale value is after the 5 years. In order to do so, you need to perform a Resale Economic Valuation. To do so, start with your sale price of $103,000 and subtract 1% from that price every month (or multiply by .99).

Continue to multiply each month by 99% until you hit the 5 year mark. In this example, our estimated resale value is about $56,926. Add the resale value into your 5 year rental profit to get the total 5 year profit.

| Resale Valuation | ||

| January 1, 2020 | $103,000 | |

| February 2020 | $101,970 | Reduces the valuation by 1% per month |

| March 2020 | $100,950 | |

| April 2020 | $99,941 | |

| May 2020 | $98,941 | Duplicate the calculation over the useful life |

| December 31, 2024 | $56,926 |

ROI Calculation Example: Putting the Steps Together

| Step 1: Calculate the Deprecation – ROI CALCULATION | |

| Acquisition Cost | $103,000 |

| Depreciation Schedule (Months) | 60 |

| Depreciation per Month | $1,716.67 |

| Step 2: Identify Retail Rental Rate – RENTED AS A 150′ | |

| Retail Rental Rate per Mo | $13,500 |

| Profit per mo as a 150′ | $11,783 |

| Annual Potential Profit | $141,400 |

| At 80% Utilization | $113,120 |

| At 70% Utilization | $98,980 |

| At 60% Utilization | $84,840 |

| At 50% Utilization | $70,700 |

| Step 2.5: Identify Retail Rental Rate if You Rent Down – RENTED AS A 135′ | |

| Retail Rental Rate per Mo | $8,500 |

| Profit per mo as a 135′ | $6,783 |

| Annual Potential Profit | $81,400 |

| At 80% Utilization | $65,120 |

| At 70% Utilization | $56,980 |

| At 60% Utilization | $48,840 |

| At 50% Utilization | $40,700 |

| Step 3: Calculate a BLENDED Average Retail Rate | |

| Avg Rental Retail Rate ( (150′ rate + 135′ rate) / 2 ) | $11,000 |

| Profit per mo at Blended rate | $9,283 |

| Annual Potential Profit | $111,400 |

| At 80% Utilization | $89,120 |

| At 70% Utilization | $77,980 |

| At 60% Utilization | $66,840 |

| At 50% Utilization | $55,700 |

| Blended Avg Profit Over 5 Yrs at 60% Utilization | $334,200 |

| Resale Value in 5 Yrs | $56,926 |

| Gross Profit in 5 Yrs | $391,126 |

| Net Profit in 5 Yrs | $288,126 |

| Payoff Period in Yrs | 1.54 |

Using our 60% utilization of our blended retail rate example as previously mentioned, after 5 years we would have a made about $334,200, if we add that to the resale value calculated in step 5, we come up with a gross profit of $391,126 after 5 years.

We then need to subtract the original cost of the equipment $103,000 from that number to find our net profit over 5 years.

$391,126 – $103,000 = $288,126

Given a 60% utilization, your net profit from the machine rented at both a 135’ and 150’ boom is $288,126 and you can expect to pay off the price of the machine in 1.5 years.

When purchasing new or used construction equipment, make sure to perform the proper calculations to ensure that you are making a smart purchase.

I’m getting a construction project together, but I want to make sure that I get everything together that I need. It would be good to remember that I will need to rent scaffolding. I’ll make sure that I find good deals on the rental prices.

Excellent explanation. Anyone can easily comprehend since it’s simple & focused. Keep up the great work!

Thanks for the note!

It is one of the best write up on how to purchase construction equipment calculating the return on investment. Before hitting on the other blogs I would request all to give a try here to get the best available content here. The article is much informative regarding work as well.

Thanks!

Thanks for this wonderful post. The writer has taken a lot of time and effort to post this information on the website.

I’m glad you talked about construction equipment and how to know if it’s worth buying it. Recently, one of my cousins said he’s interested in investing in a construction project. My cousin needs to buy or lease the equipment for the job, so I think your article could help him. Thanks for the advice on what to consider when purchasing construction machinery.

At our line of work, knowing the details to purchasing a new excavator for water and sewarage mains installations is a great help!! Thanks

Thanks for the reminder that it’s important to also consider the retail rates when looking for a construction equipment dealership. I’d like to buy new equipment soon because I’m thinking about getting an extension project done in one of my properties. Being able to acquire the proper equipment for that would be very important.

The advice given in the article is practical and easy to follow, making it a valuable resource for both newcomers to the industry and experienced professionals. By considering the total cost of ownership and evaluating the benefits each piece of equipment brings to the table.